Obtain Direct Loans Online with no Brokers

Working out your finances can pose challenges – particularly when your monthly expenditure temporarily exceeds your income. Resulting shortages can make it difficult to pay your bills, and if a spending emergency unexpectedly strains your finances, additional resources may be required, making ends meet. Online loans and direct loans with no brokers offer valuable financial assistance when you need immediate monetary relief.

How much would you like?

Representative Example: Rates from 12.9% APR to 1625.5% APR. The minimum Loan Term is 1 month. The maximum Loan Term is 36 months. Representative Example: £1,000 borrowed for 18 months. Repayment of 17 Months at £87.22 and final repayment of £87.70 The total amount repayable is £1570.44. Interest amounts to £570.44, an annual interest rate of 59.97%. Representative APR: 79.5% (variable).

Various short-term finance solutions provide small sums of money in a hurry. Payday loans, guarantor loans, direct loans with no brokers, and other online resources are frequently utilised when employment income falls short. The short-term solutions fill cash flow gaps between paydays, delivering enough money to get by until salary day.

Advantages of Direct Loans Online

UK consumer finance alternatives cover a wide variety of funding needs. Among the financial solutions found online, direct loans with no broker present several short-term finance advantages. As you weigh the pros and cons of various funding options, consider the following benefits of direct loans with no brokers.

- Accessibility – UK lenders are required to consider loan applicants’ credit references, before extending finance terms. Banks and building societies rely on comprehensive credit checks to evaluate loan requests, which may delay access for some applicants. Online lenders also review credit conditions, but their process emphasizes income and employment, resulting in high acceptance rates. If your credit file shows prior payment inconsistencies or other credit problems, traditional lenders may decline your loan request. Because they fund flexible short-term loans, backed by users’ employment income, online providers offer accessibility for good and bad credit.

- Ease of Use – Obtaining conventional financing may require in-person application and substantial supporting documentation. Online alternatives offer direct loans with no brokers, administered entirely online. Ease of use not only makes online loans more convenient than many brick and mortar lending alternatives, but you can apply online without extensive paperwork. Omacl’s straightforward application for funding takes only a few minutes to complete, initiating your online request for fast financing. Whether at home or on the go, your connected laptop or mobile device is all you need to apply for secure direct loans with no brokers.

- Speed – Spending emergencies arise without warning, so there isn’t always time to save money or devise personal financial solutions. Fortunately, quick loans with no brokers and other types of payday funding serve a vital niche, offering immediate access to cash, when you can’t afford to wait for traditional bank approval. The flexible loans fund quickly, with no credit check delays or service slowdowns. You won’t wait long for answers, after applying online – approved loans receive direct bank transfers.

- Flexibility – Flexible usage makes direct loans suitable for a wide variety of spending functions. Unlike mortgages, student loans, and other types of funding that are earmarked for specific finance needs, direct loan usage is not limited to a particular function. Direct loan proceeds are commonly utilised for household spending emergencies, cash flow shortfalls, medical bills, education, and other personal financial priorities. Whether you need a £2,000 loan for family holiday or £200 to hold you until your next salary day, direct loans cater to diverse funding requirements.

Eligibility and Affordability

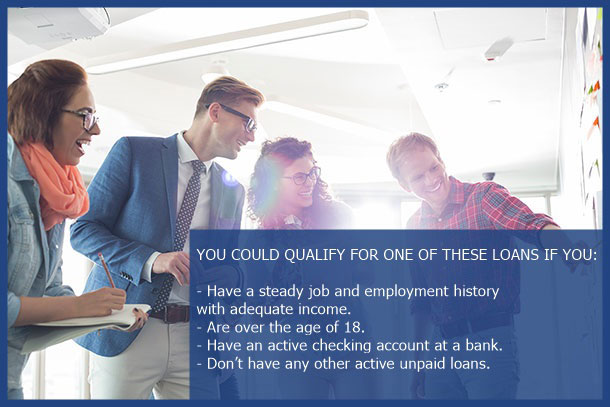

Short-term online lenders offer small sums of money, in exchange for prompt payday payments. In order to qualify for direct loans with no brokers, you must first meet basic eligibility standards for acquiring cash online. Approved direct loan candidates

- are at least 18 years old at the time of application,

- maintain current accounts for making direct payments and receiving loan transfers,

- have employment income sufficient to cover loan repayment responsibilities,

- reside in the UK.

In addition to basic eligibility requirements, loan candidates are also subject to rules and terms imposed by each lender.

Before entering into an online finance agreement, it pays to assess your financial needs and measure repayment affordability. Evaluating conditions helps determine your best funding approach, matching your finance need with resources such as direct loans, payday loans, and similar online solutions.

- Do you need a small amount of money? – Every finance need is distinctive, so the first step toward fast resolution is measuring your monetary needs. Omacl can help you obtain loans valued at as much as £2,500, but the flexible online loan broker can also assist with smaller sums. When your paycheck falls short, requiring a few hundred pounds until salary day or you are caught off guard by a £2,000 car repair bill; direct lenders can help you stay on track. However, flexible direct loans are not available for financial conditions that require substantial multi-year resources valued at more than £2,500.

- How much time do you have? – Urgent financial needs won’t wait until payday. Direct loan approval is not slowed by traditional bank acceptance protocols. Rather, online loans serve the need for speed, providing immediate access to money for your most pressing financial priorities. When you can’t afford to wait-out a long approval period, direct loans offer a timely finance alternative, known for delivering quick cash.

- Are you prepared to repay the loan? – Short-term finance opportunities are subject to the terms of individual loan agreements, accepted by all the involved parties. The legally binding arrangements outline repayment expectations, including due dates and minimum payment amounts. Although your lender will evaluate financial conditions before accepting your funding request, your own affordability review is also important, assessing both household income and outgoing financial obligations. Is your income adequate to cover necessary payments? Do you expect other financial challenges during the repayment period? Is your job secure? Answering questions such as these – to the best of your ability – sets the stage for trouble-free payback.

- Are you facing short-term finance needs? – Long-term financing options include mortgages, car loans, and substantial personal loans requiring years to repay. Direct loans are not aimed at long-term finance needs. Rather, the flexible funding provides strictly short-term relief, requiring prompt repayment. Beginning with your next paycheck, online lenders expect steady instalment payments, until you’ve cleared the entire loan balance.

Important Things to Consider Before Borrowing Money

Your financial reputation is at stake each time you open a new line of credit. Making timely payments and wiping a loan balance can boost your credit score and reinforce your financial health. Late payments, loan default, and other payback problems are sure to have the opposite effect, driving down your credit score and reducing your access to future financing. In order to protect yourself from credit downgrades and facilitate positive credit outcomes, it is important to consider several vital aspects of any lending opportunity.

How Does Omacl Compare?

Direct loans and other payday finance alternatives offer short-term financial relief, when your paycheck doesn’t meet your monthly expenditure. The flexible resource can help you stay current with bill payments and address financial emergencies, whilst waiting for your next salary day. If you need a small sum of money for a short period of time, direct loans may be the financial backstop you’ve been looking for.